NEW REPORT: NHS Set to Miss Out on Vital Biologic Medicine Savings in the Next Five Years

Download the report here (PDF download)

- 85 biologics are set to lose patent exclusivity in the next five years

- However, soaring VPAS rates on top of competition is making the UK economically unviable

- A failure to launch new products and provide competition will cost the NHS billions of pounds

- UK set to lose European leadership position in biosimilars

Billions of pounds of vital NHS savings from biological medicines could be under threat because of a rising Government tax on manufacturers’ revenues, according to a new UK biosimilar sector report.

The British Generic Manufacturers Association (BGMA) has published a new report looking into the state of off-patent biologics and their potential to drive further savings to the NHS. For the first time, it analyses the impact of reduced biosimilar competition on the 85 biologics which are due to lose patent exclusivity in the next five years.

According to the NHS, biological medicines are currently the largest cost and cost growth areas in the medicines budget. NHS England is aiming to making biosimilar medicines more quickly available to drive significant savings while also enabling more patients to have access to lifesaving and life-enhancing treatments.

However, this is under threat from the impact of the Government’s voluntary scheme for branded medicines pricing and access (VPAS) scheme. This is an agreement between the Department of Health and Social Care (DHSC), NHS England and The Association of the British Pharmaceutical Industry (ABPI).

The scheme aims to limit increases in spending on branded medicines to no more than 2% per year via a rebate system which is charged on companies’ sales revenues.

Two years ago, the rate was 5.1%, but in 2023 it has soared to 26.5%. Due to regulatory reasons, all biosimilars and a proportion of the generics market falls into the scheme for which the next five-year period is currently being negotiated.

Off-patent products such as biosimilars already face cost controls via competition with prices typically reducing on average by 72% compared to the originator product. In the last five years, the growth of biosimilars has, in volume terms, increased by nearly six times. Over the next VPAS period from 2024 to 2028, more than 85 biological medicines will lose their exclusivity.

This includes blockbuster products such as cancer medicine Keytruda and wet macular product Eylea. Between them they generate global sales in the region of $25bn. Other disease areas covered by the molecules coming off-patent include oncology, diabetes, arthritis and asthmas. This means the biosimilar market growth trend should continue providing a significant savings opportunity for the NHS.

However, the rapidly rising VPAS rate is threatening the launch of new biosimilars with many manufacturers not able to absorb the cost of competition as well as the soaring VPAS rebate rate. With the economics unviable, companies will prioritise other markets over the UK or fail to launch here altogether.

The report details new data analysis from Europe Economics and RFW Associates, which shows the potential cost impact of this lessening in competition for just new biological molecules set to lose exclusivity in the next five years. The research shows that if on average one company is deterred from entering a biosimilar market where molecule exclusivity has been lost between 2023 and 2028 then the NHS is projected to lose out on around £100million in savings per year by 2028. If two entrants were lost, then this figure rises to £250million. A modest assessment from the analysis shows that this could comfortably total over a billion pounds of lost savings on new products alone in the next five years.

This data follows on recent research by Professor Alistair McGuire, London School of Economics, and the Office of Health Economics which showed that the NHS would pay £7.8bn in higher medicine prices if the VPAS levy stays at the current rate for branded generics and biosimilars for the next five years across existing and new branded generics and biosimilar portfolios. This is because of product withdrawals and a decline in new off-patent product launches, reducing competition.

Mark Samuels, Chief Executive of the BGMA, said: “Biosimilar medicines are integral to the NHS. They deliver significant savings and widen access to more medicines for patients earlier. Manufacturers can do this because they generate and operate in a competitive medicine market. However, given the increasingly constrained fiscal environment the NHS must operate in, it is critical there are no barriers to this.

“The current VPAS negotiations present a very serious risk to this competitive market thriving and delivering ongoing benefits to patients. Without reform of the current VPAS arrangements, biosimilar companies will simply not choose to launch new products in the UK. This will threaten the UK’s leadership position in biosimilars which it has achieved over the past few years based on a strong partnership approach between industry, government, NHS England, and the regulator. We are in grave danger of wasting the opportunity and will lose ground on other countries.

“Our new analysis shows that on a conservative scenario basis, the NHS will miss out on more than a billion pounds of savings from the new pipeline of 85 biologics which are due to come off-patent in the next five years. We need the Government to understand the very serious implications and negotiate a VPAS scheme which recognises the key differences between how the on- and off-patent sectors operate understanding the benefits competition brings.”

In June 2023, three of the most respected health policy academic institutions, the LSE, the University of York and the London School of Hygiene and Tropical Medicine, published a report entitled: “Promoting population health through pharmaceutical policy: The role of the UK Voluntary Scheme”.

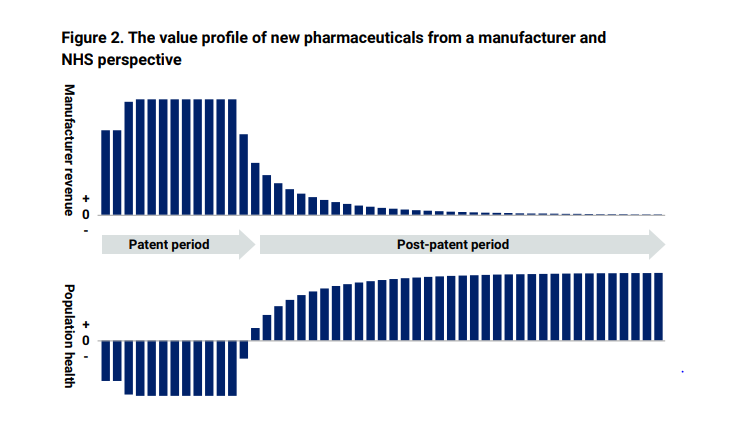

The report set out how a medicine’s value is distributed between the manufacturer and NHS patients over its life cycle. During the on-patent period, revenue mainly accrues to the manufacturer due to the drug’s monopoly protection. During this period, NHS patients experience a health deficit as the new medicine’s benefits are outweighed by the impact on other NHS services. After the patent period, NHS patients start receiving significant net benefits from the availability of cheaper generic or biosimilar versions of the medicine.

The report sets this out in two graphs. Taken together, they show why it is so important that the Government fosters a competitive and healthy off-patent market since as the patent period expires and competition can take effect, what the NHS pays goes down (the top graph) while the benefit to NHS patient goes up (the bottom graph).

Additionally, IQVIA data from 2019-2022 shows that on-patent medicines sales grew by 18% year on year since 2019, while off-patent branded medicines increased by 2% each year in this time. This has in effect meant that the off-patent sector has made a far higher contribution to the overall branded medicines growth rate than it is responsible for. This has subsidised single-source on-patent manufacturers.

If the off-patent sector had only to contribute for its own growth in value of sales to the NHS above 2% over these past three years, it would have had to repay the NHS nothing in 2020 and 2022, since it grew less than 2%. Despite this, the off-patent sector has had to shoulder a repayment of £282m in 2020, £246m in 2021 and £735m in 2022.

The biosimilars report has been jointly put together by the British Generic Manufacturers Association (BGMA) and the British Biosimilars Association (BBA). The BBA is the expert sector group of the BGMA focused on biosimilars.

Download the report here (PDF download).

ENDS

For further information about the BGMA please contact Jeremy Durrant on 07792918648 or email Jeremy.durrant@britishgenerics.co.uk

About the British Generic Manufacturers Association (BGMA)- The BGMA comprises members of the generic manufacturing supply industry, who account for approximately 85% of the total UK generic market by volume.

- They supply 4 out of 5 drugs used by the NHS.

- BGMA members include eight of the ten largest medicine suppliers to the NHS.

- A key feature of the strong generics industry in the UK is that it introduces competition to the supply of prescription medicines, making them more affordable to the NHS and enhancing their availability to patients.

- According to NHS figures (NHS Digital), more than a billion items are prescribed generically every year. The competition provided by generic medicines saves the NHS around £ 15 billion annually.

The British Biosimilars Association (BBA) is the expert sector group of the British Generic Manufacturers Association (BGMA) exclusively focused on biosimilars. The members of the BBA ensure access to high quality, safe and effective biosimilar medicines for UK patients. As industry experts, we partner with patients’ representatives, healthcare professionals, regulators and payers to increase understanding and to drive a sustainable environment for the development, production and continuing optimised use of biosimilar medicines across the UK.